XPeng frente a Tesla: ¿Está este gigante de la movilidad $26B AI profundamente infravalorado?

On November 11, XPeng Motors’ stock price skyrocketed by 18%. This surge links closely to “her”—an innovation so impressive it even earned a nod from Elon Musk.

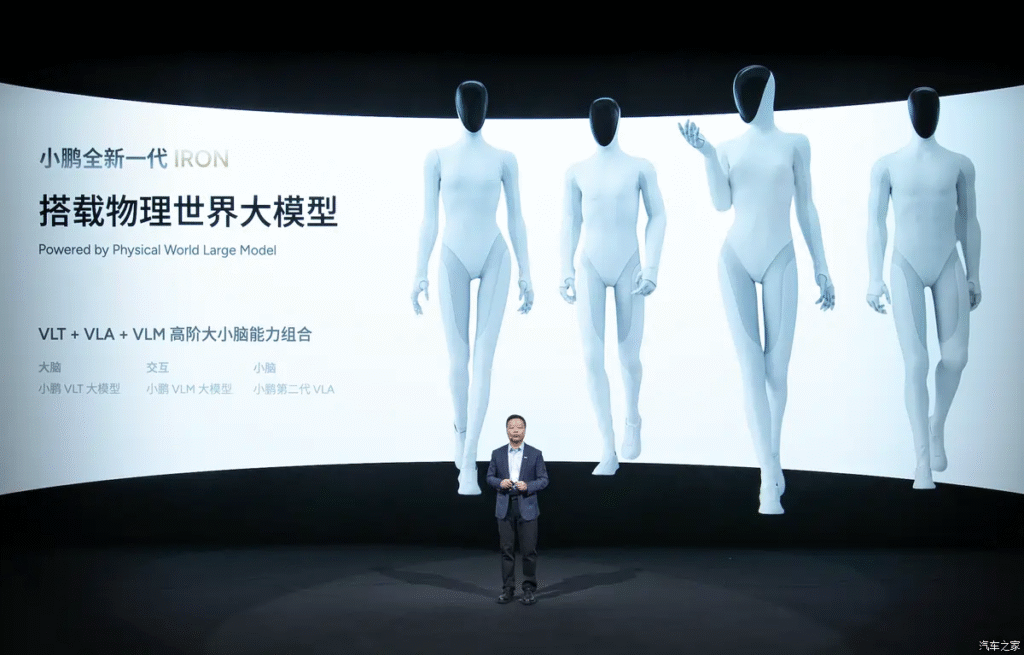

The buzz started at XPeng’s Tech Day on November 5. The company announced it would mass-produce its second-generation humanoid robot, IRON, by 2026. This robot is famous for its “catwalk” capability. Just a day later, Tesla announced its third-generation Optimus robot. It’s capable of sorting materials and also aims for 2026.

Elon Musk subsequently praised the XPeng IRON. He even commented that the female-presenting robot had a “nice figure.”

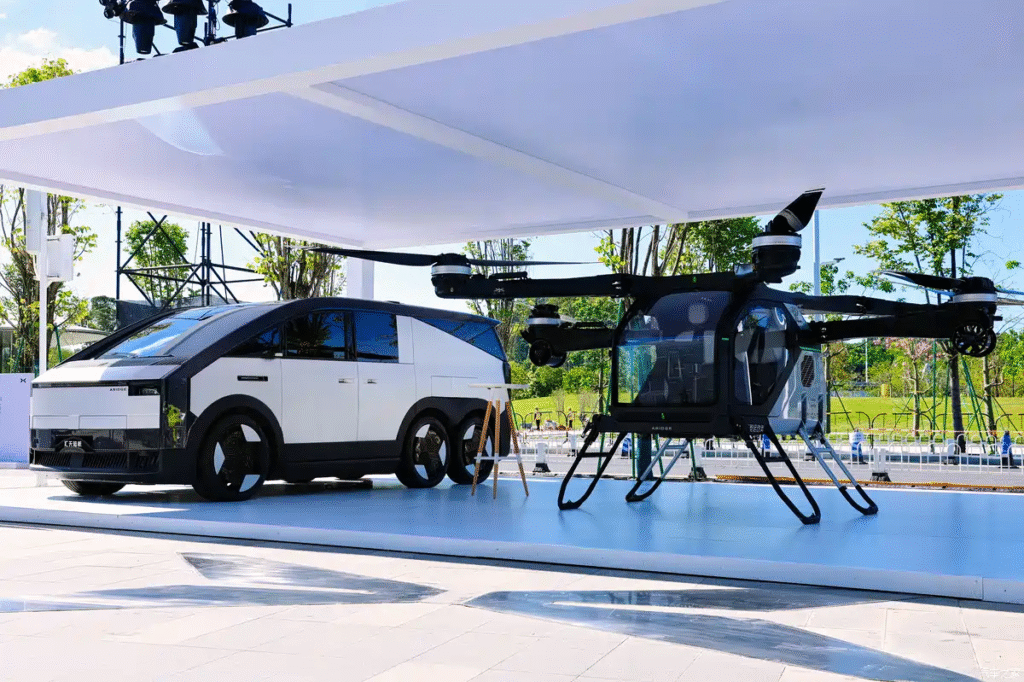

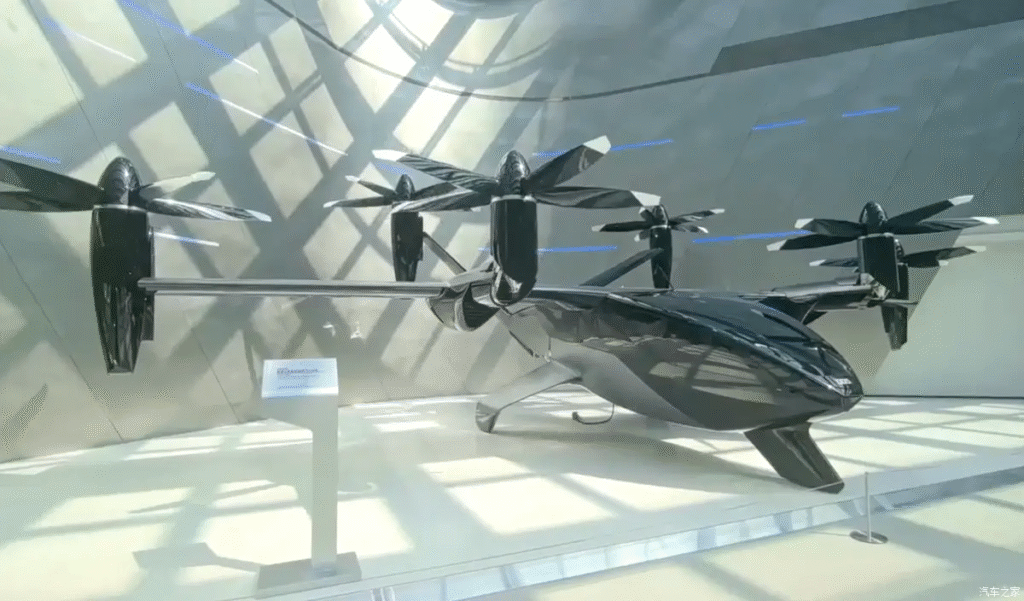

The parallels don’t stop at robotics. XPeng’s CEO, He Xiaopeng, also announced new plans. He intends to mass-produce the modular flying car, the “Land Aircraft Carrier,” starting in 2026. Not to be outdone, Musk immediately declared that he would unveil the new “flying” Roadster by the end of the year.

Today, XPeng has built a full-stack, self-researched “physical AI” system. It covers chips, operating systems, and smart hardware. Coincidentally, Tesla has already constructed a similar system.

A 54x Valuation Gap

As of now, XPeng is unique. It’s the world’s only tech company simultaneously developing AI-powered cars, Robotaxis, humanoid robots, and flying cars. If the new Roadster can truly “fly,” Tesla might just become the second.

Yet, a massive gap remains. As of the market close on November 11, XPeng’s market cap was $26.80 billion. During the same period, Tesla’s market cap reached a staggering $1.46 trillion. That’s about 54 times larger.

If these two companies are so similar, why is their valuation so different?

Factors like the Mars program and Musk’s personal charisma support Tesla’s high valuation. Still, it’s time to re-evaluate XPeng’s future.

The Automotive Business: Still Undervalued?

XPeng has four major business lines. These include passenger cars, Robotaxis, humanoid robots, and flying cars. Since the latter divisions are not yet in mass production, the company’s current market cap primarily reflects expectations for its auto business.

In the first 10 months of 2025, XPeng delivered 355,000 new vehicles. This was a 190% year-over-year increase, hitting its annual target two months early. In the first three quarters, Tesla’s sales were 1.2177 million units, about 3.9 times XPeng’s. However, Tesla’s revenue was about 8 times larger.

XPeng’s advantage is its powerful growth momentum. Starting in Q4 2025, XPeng will also enter the extended-range (EREV) market. Competing in both the pure electric and extended-range sectors gives XPeng significant room for future growth. Meanwhile, Tesla’s sales have shown signs of slowing down.

Building a Full-Stack Technology Moat

For a tech-driven company like XPeng, we can’t just look at car sales. After all, Geely and Chery have sales 5-6 times higher than XPeng’s, but their market caps are at a similar level.

Unlike traditional automakers, XPeng and Tesla chose the path of full-stack self-research. They develop in-house operating systems, autonomous driving, smart cockpits, smart driving chips, and E/E architecture. In short, they control all core smart-car technologies.

This deep in-house R&D has built a significant technological moat and saved a lot of money. In the second quarter of 2025, XPeng’s gross margin reached 17.3%, surpassing Tesla’s 17.2%.

This R&D also allows for technology “spillover.” The deepening relationship with the Volkswagen Group is a direct result of this strategy. In the future, VW Group will use XPeng’s second-generation VLA and Turing chips.

Simultaneously, XPeng will open its Robotaxi SDK (Software Development Kit) for collaboration. It has already partnered with Alibaba’s Gaode.

Therefore, we should evaluate XPeng as a “carmaker + supplier” of smart chips, autonomous driving, and operating systems. For comparison, Li Auto and Seres have similar delivery volumes. Their market caps are $21.43 billion and $32.79 billion, respectively. While XPeng’s revenue is slightly lower, its growth rate is significantly stronger.

The “Catwalking” Robot: Mass Production in 2026

Many people mistook the second-generation IRON for a “person in a suit.” This fact alone demonstrates XPeng’s prowess in lifelike robotics.

LC (Mi Liangchuan), head of XPeng’s robotics division, revealed he has spent the last year intensely studying human anatomy. This research allowed the IRON to achieve 82 degrees of freedom (DOF), with 22 in each hand. In comparison, Yushu Technology’s latest hand has 20 DOF, and the Tesla Optimus also has 22.

However, XPeng’s compute power is in another league. XPeng equipped the IRON with three Turing AI chips. These boast an industry-high 2250 TOPS of computing power.

AI Brains and Market Value

XPeng built its software on a VLA (Vision-Language-Action) + VLM (Vision-Language Model) + VLT (Vision-Language-Task/Thinking) combination. XPeng specifically developed the “VLT large model” for the robot. It enables the machine to perform deep thinking and autonomous decision-making.

According to LC, the IRON only needs an “input direction and speed” to act. It autonomously generates all other movements and gaits. XPeng targets mass production in 2026 and has already secured partners like Baosteel.

He Xiaopeng believes that humanoid robots will one day be in every home. He sees a future market size double that of automobiles. He predicts XPeng’s robot sales will exceed 1 million units annually in 10 years. Musk is even more bullish, forecasting billions of Optimus units, “surpassing mobile phones.”

For context, investors valued US-based Figure AI at $39 billion in its C-round. China’s top three are UBTECH ($8.43 billion), Zhiren ($2.11 billion), and Yushu Technology. What, then, is XPeng’s robotics division worth?

Conclusión

We should not compare XPeng to Tesla in terms of current market cap. But, like Tesla, we should not see it as just a car company. It has explored AI cars for 11 years, flying cars for 12, and robotics for over 7.

At its recent Tech Day, He Xiaopeng updated XPeng’s positioning. He called it a “Physical AI world mobility explorer” and a “global embodied intelligence company.”

Following the event, Morgan Stanley rated XPeng as “Overweight” with a $30 price target. CICC maintained its “Outperform” rating with a $28 target.

If we simply value XPeng’s parts, the sum is already far greater than its current market cap. But if we view its AI cars, Robotaxis, flying cars, and robots as one symbiotic ecosystem, its true value is far greater still.

Accessing the Future of Mobility with HiLUCK

The story of XPeng is a powerful example of the advanced, high-tech automotive ecosystem emerging from China. As these innovations in AI, EV technology, and robotics move from R&D to mass production, the global demand for these products is undeniable.

For businesses worldwide looking to source the best of this new automotive generation—from complete electric vehicles to advanced auto spare parts and body kits—navigating the market is key.

Aquí es donde HiLUCK excels. As a leading B2B automotive export partner, we specialize in connecting global clients with cutting-edge Chinese automotive solutions. Whether you’re interested in the latest EV models, advanced components, or DMI-full body kits, HiLUCK provides the expertise and access to help your business thrive.

Learn more about how we can help you be part of this mobility revolution.

What heights do you think XPeng will reach in the future? Share your unique insights in the comments section below!