Preface

The global automotive industry is undergoing a major transformation unseen in a century. The continuous innovation and rapid evolution of intelligent technologies are reshaping the industry landscape and having a profound impact on the transportation ecosystem. Today, “intelligence” has become a crucial and indispensable feature of automobiles, and a crucial battleground for automotive OEMs in their technological competition.

On September 21st, at the Autohome Global AI Technology Conference, Xian Bijuan, Vice President of the Autohome Research Institute, released the report titled “New Paradigms of Intelligence Reshape Competition—Insights into China’s Smart Electric Vehicle Development Trends in 2025.” Based on industry observations, Autohome’s vehicle model database data, and user demand tracking, we have summarized and refined five core trends in the intelligent development of China’s electric vehicles. Using Autohome’s AH-IT intelligent evaluation system, we demonstrate the authentic intelligent experience of powerful models.

Driven by both the demand and supply sides,

The importance of intelligence continues to increase

Intelligence has become the primary reason consumers choose new energy vehicles over gasoline-powered ones . Three years ago, only 30% of consumers held this view, but now that percentage has risen to 73%, with this percentage being particularly pronounced among mid-range and high-end buyers. Clearly, intelligence has become synonymous with new energy vehicles.

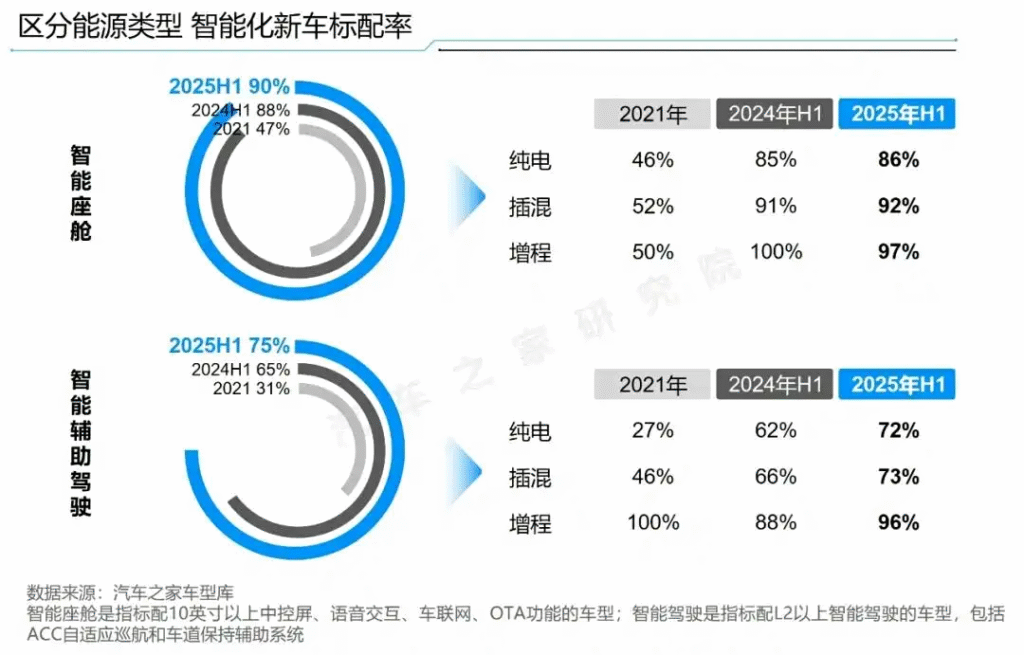

From a vehicle supply perspective, both the standardization rate of intelligent features on new vehicles and the penetration rate of intelligent features on existing vehicles are increasing year by year . Especially driven by the industry trend of “equal access to intelligent driving,” both the standardization rate and penetration rate of L2 intelligent assisted driving on new vehicles are expected to increase by 10 percentage points by 2025, reaching 75% and 65%, respectively, ushering in a new round of accelerated growth.

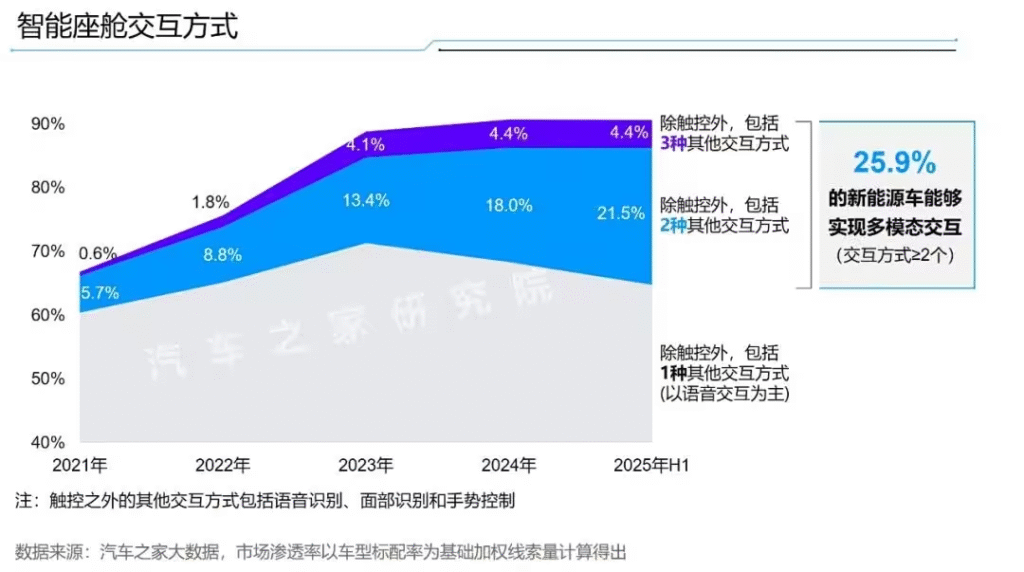

The penetration of specific configuration functions varies. Among smart cockpit features, interactive configurations have seen a significant increase in penetration : Zoned voice wake-up and continuous voice recognition, responsible for interactive perception, have reached 70% penetration; DeepSeek, responsible for interactive decision-making, and the central control screen, responsible for interactive feedback, have also seen rapid growth in penetration.

Intelligent assisted driving features are rapidly gaining popularity , with the annual penetration rates of many features increasing significantly. Forefront sensing cameras, lane keeping, lane change assistance, and door opening warning are accelerating their penetration, reaching mainstream adoption by 2025. Assisted parking has seen its penetration rate increase from 28.6% to 46.5%, the largest increase among assisted driving features, and is expected to enter the mainstream in the second half of 2025.

Annual Trend 1

“Smart Driving Equal Rights” fully launched

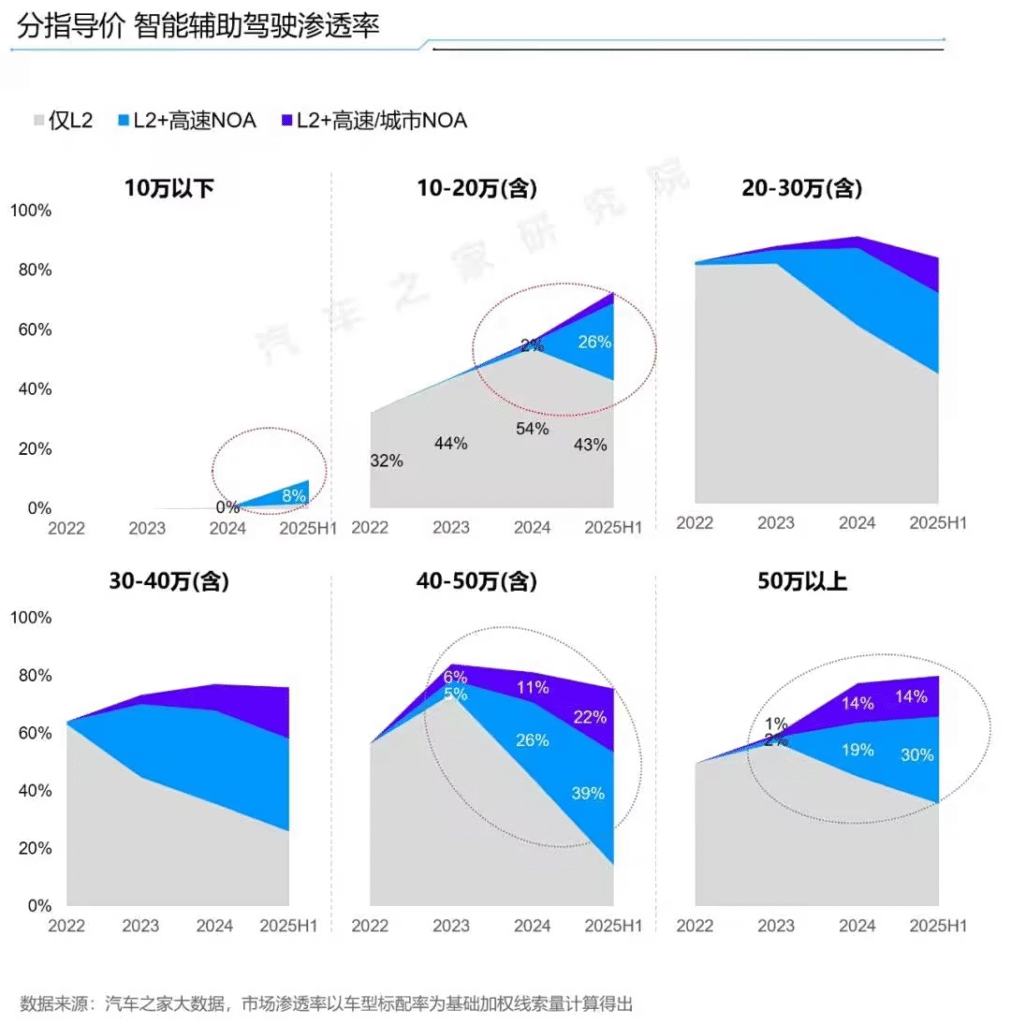

By early 2025, driven by automakers like BYD, Changan, and Geely, “smart driving equality” was gaining momentum. Vehicles equipped with highway assisted driving capabilities saw their prices drop below 100,000 yuan, while those equipped with urban assisted driving capabilities dipped below 200,000 yuan, driving a breakthrough in the penetration of both highway and urban NOA in the lower price range. Autohome’s big data shows that the penetration of smart assisted driving in the mid- to low-priced segment below 200,000 yuan has rapidly increased. Penetration in models below 100,000 yuan has grown from zero to 73% in the 100,000-200,000 yuan segment, up from 57% in 2024 to 73% in the first half of 2025. Of course, the penetration of high-end models has also continued to expand. Smart assisted driving in models priced above 400,000 yuan, which had previously been a low point, has clearly caught up this year.

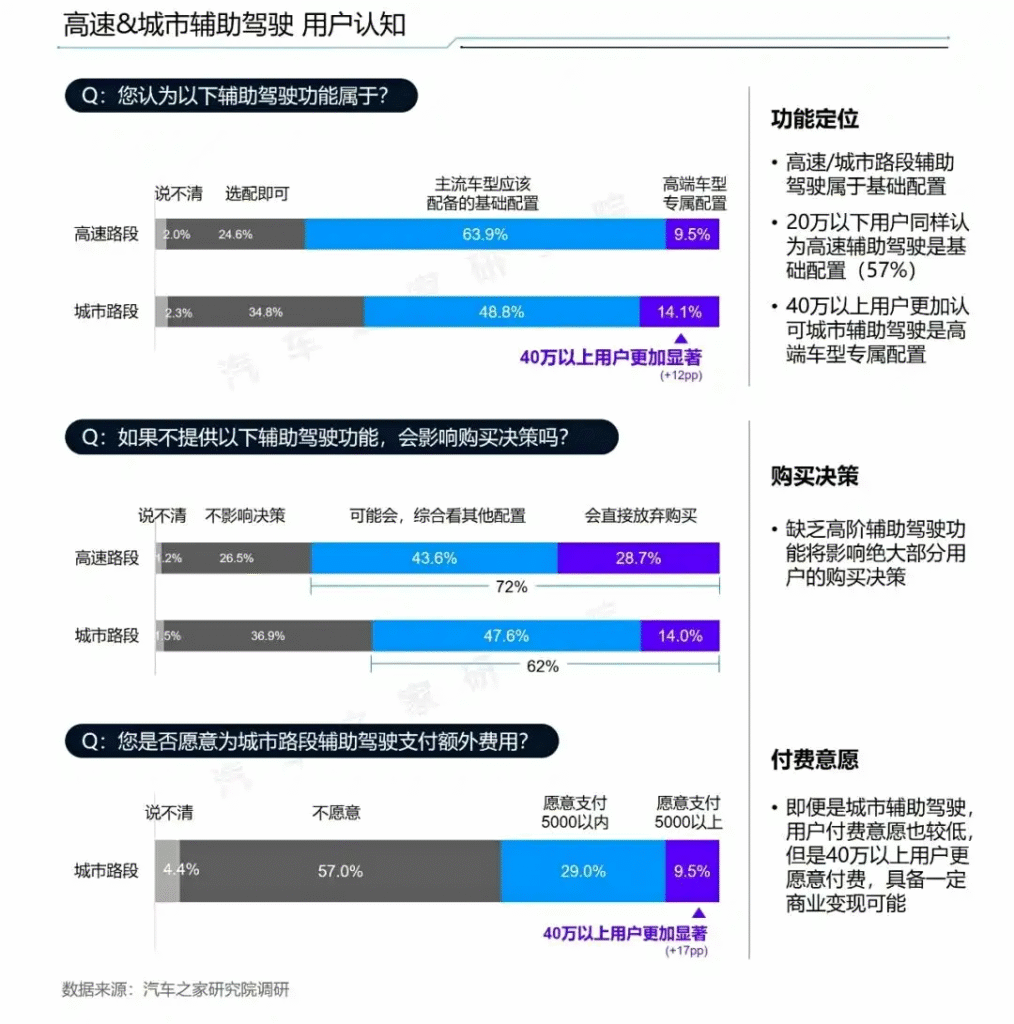

Under the auspices of the “Smart Driving Equal Rights” initiative, user attitudes have also undergone a significant shift. Over 60% of users believe that highway assisted driving should be a “basic feature on mainstream models .” Even among those purchasing vehicles priced below 200,000 yuan, 57% believe it should be standard. The same holds true for urban assisted driving , with nearly half of users considering it standard. Given this perception, 60% to 70% of users are likely to forgo a purchase without Highway & Urban NOA and are less willing to pay for it as an option, further minimizing the potential for commercial success .

Of course, there’s still a glimmer of hope for high-end users. On the one hand, a higher proportion of high-end users believe that Highway & Urban NOA is “exclusive to high-end models,” making it a valuable differentiating feature. On the other hand, high-end users are relatively willing to pay, with 27% of users with over 400,000 yuan willing to pay over 5,000 yuan.

Another shift is the demand for test drives before purchasing a car. More users want to experience intelligent assisted driving in everyday scenarios . 72% of users want custom routes, such as a home-to-work commute, to test the usability of intelligent assisted driving. They also want to experience complex road conditions to assess the reliability of assisted driving in extreme scenarios. Furthermore, due to limited user awareness of highway and urban NOA functions, nearly 60% of users want to include relevant function demonstrations and training during their test drive.

Annual Trend 2

AI big models collectively “get on board”

By early 2025, DeepSeek had broken through the market at an astonishing pace, unleashing an unprecedented wave of AI technology integration in the automotive industry. Over 20 automakers announced integration of various DeepSeek-based AI models within a single month, setting a record for the fastest pace of technological upgrades in China’s automotive intelligentization journey. Autohome’s big data reveals that DeepSeek has been prioritized for integration in mid- to high-end models priced over 300,000 yuan, while models priced below 300,000 yuan are expected to launch the feature, indicating that this feature will rapidly penetrate lower-end and mid-range models. If all models already connected to the DeepSeek app and those about to receive it are included, the DeepSeek app penetration rate will exceed 20%.

Leading brands have an inherent advantage in user awareness. The higher the brand’s market position, the greater its users’ awareness of big AI models, providing greater support for both brand and product development. However, for users, access to big AI models is still in its early stages of adoption, and only a small number of users have experienced its features. Of those who have, two-thirds express satisfaction .

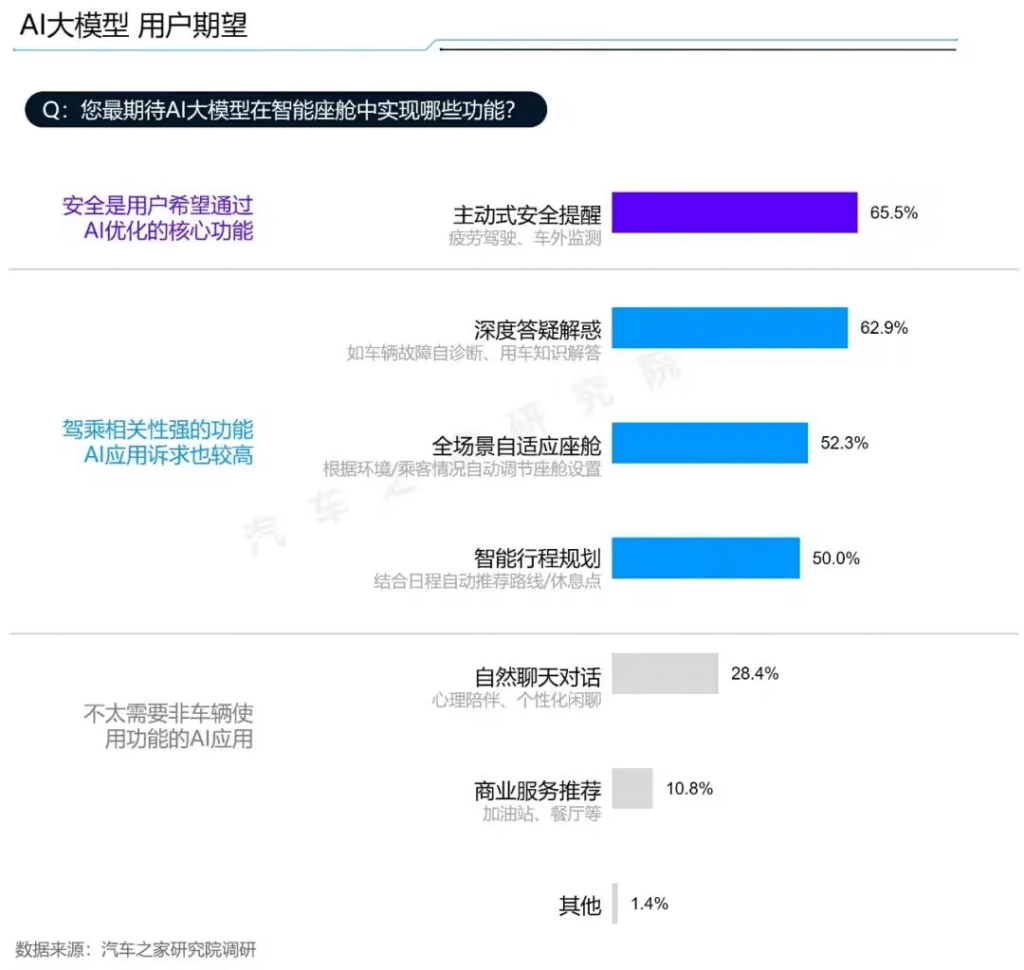

In terms of functionality, users’ greatest expectation for AI big models is “safeguarding” driving safety . For example, users hope that AI big models can provide better proactive safety reminders. Over half of users also hope that AI big models can enhance their driving experience with features closely related to driving, such as vehicle fault diagnosis, in-depth vehicle knowledge and answers, adaptive cockpit adjustments for all scenarios, and intelligent itinerary planning. Conversely, demand for non-vehicle features like chat and business service recommendations is low.

Annual Trend 3

Smart cockpit diversified experience upgrade

In the smart cockpit, multimodal interaction is the primary direction for experience upgrades . Since 2023, the penetration rate of multimodal interaction has rapidly increased, exceeding one-quarter by 2025. This penetration rate is even higher in vehicles priced above 200,000 yuan, and even exceeds 60% in the 300,000-500,000 yuan price range, demonstrating a distinctly high-end nature. However, even though more and more vehicles feature multiple interaction methods beyond touch, in practice, the vast majority still rely on a single method. Multiple interaction methods lack integrated control, remaining independently controlled, and thus falling short of the ideal multimodal interaction model.

Among the many interaction methods, voice control remains the most important one. With voice recognition now standard, other sub-functions under voice interaction are still evolving . First, the vehicle control functions that can be realized by voice recognition are more abundant, and the proportion of vehicle control functions that can be realized by voice recognition is growing rapidly. Second, the areas capable of voice wake-up recognition have gradually expanded from a single area in the driver’s seat to two areas in the front row and four/five areas in the second row, greatly expanding the range of drivers and passengers who can use voice recognition.

The penetration rates of other interaction methods diverge. Facial recognition, with its distinctly high-end nature, has achieved mainstream adoption in the 400,000-500,000 RMB market. While gesture control also leads in penetration in the mid- to high-end market, its technological difficulty and reliance on hardware (sensors and computing power ) will lead to stagnant or even declining growth by 2025.

Annual Trend 4

Emerging configurations shape competitive advantages

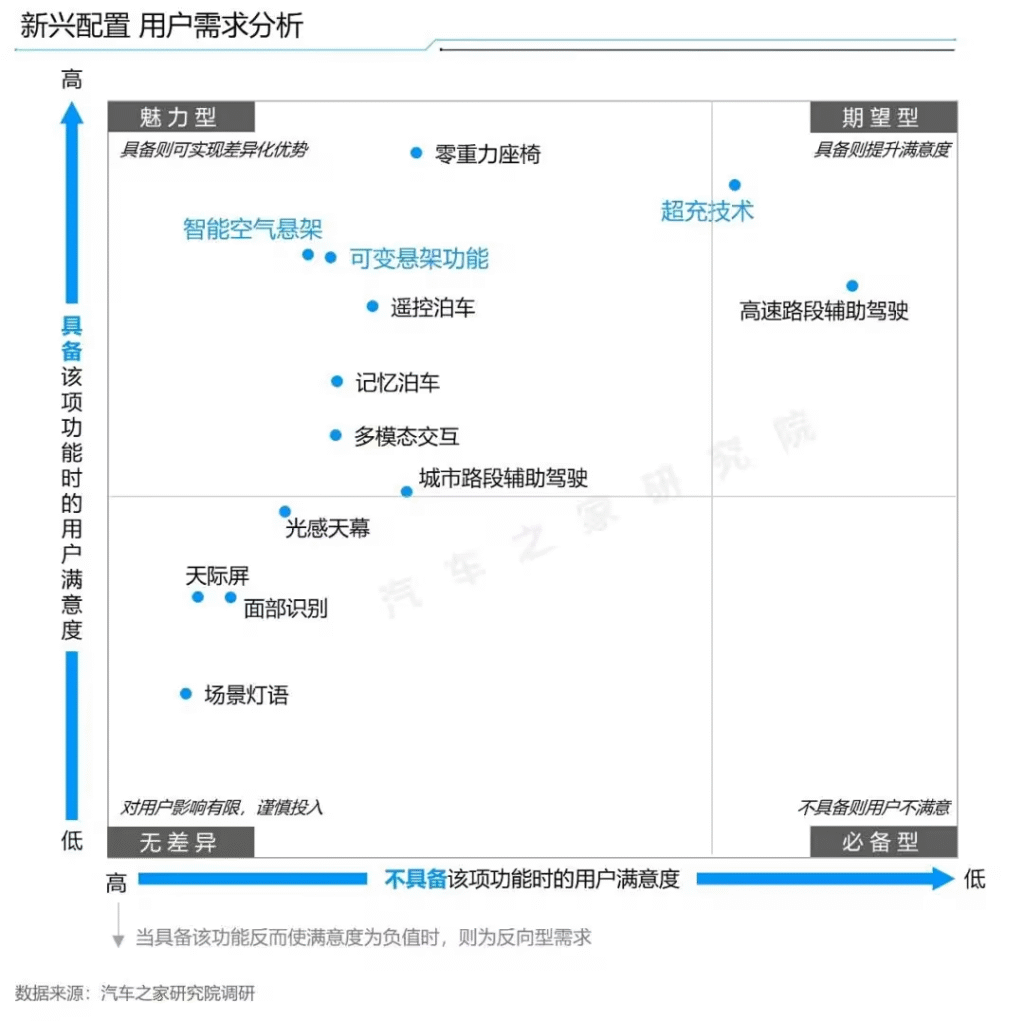

As intelligence continues to evolve, numerous new features and configurations are emerging. We selected emerging features introduced in recent years with penetration rates below 30% and categorized them based on user satisfaction using the KANO model. By testing user needs, we found that features like supercharging technology and assisted driving on highways are user-desirable features . Their inclusion significantly boosts satisfaction, while their omission can lead to a decrease. We recommend incorporating these features into mainstream configurations to meet basic user expectations. Features like zero-gravity seats and intelligent air suspension are attractive to users , offering a sense of surprise and serving as product differentiation points. However, features like scene lighting and facial recognition are less perceived by users, and their inclusion or omission has a limited impact on users. Careful evaluation of the investment-to-product ratio of these features is crucial to avoid wasting resources.

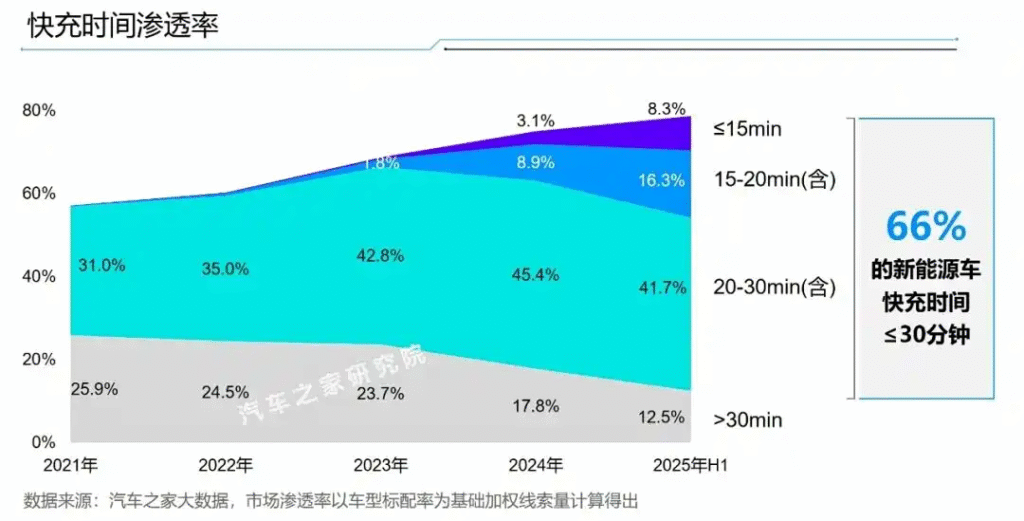

Supercharging technology is particularly noteworthy. We’ve found that, driven by models like the Wenjie M9, Xiaomi SU7 ( parameters | inquiry ), SU7 Ultra, Zhiji LS6, and Zeekr 7X, high-voltage platforms are rapidly gaining popularity in the price ranges above 500,000 yuan and between 200,000 and 300,000 yuan. Their penetration rate has exceeded 20%, making them the most popular price points for high-voltage platforms . Among models with fast charging capabilities, 66% offer a fast charge time of 30 minutes or less. Fast charging times for models priced above 500,000 yuan have been further shortened, with 24% capable of charging in under 15 minutes. This demonstrates that fast charging has become a differentiating feature for high-end vehicles.

Annual Trend 5

RoboTaxi commercialization process accelerates

China’s RoboTaxi industry is in the early stages of large-scale commercial operations, but widespread losses are a common problem. Although RoboTaxi is still exploring a sustainable profit model, Autohome Research Institute believes that RoboTaxi still has development prospects.

On the one hand, RoboTaxi can stimulate users’ desire to travel . According to research by Zhijia Research Institute, if autonomous driving becomes fully popular in the future, people will no longer need to drive their own cars. Furthermore, RoboTaxi prices will drop significantly (for example, to half the current price of online ride-hailing services). In this context, the convenience of RoboTaxi will increase the travel desire of 82% of users, such as those who are more enthusiastic about self-driving tours or feel more comfortable leaving elderly and children at home traveling alone. It will also increase user travel frequency, with nearly half of users predicting a 20-50% increase in their current travel frequency. Furthermore, nearly half of users would consider giving up public transportation in favor of RoboTaxi.

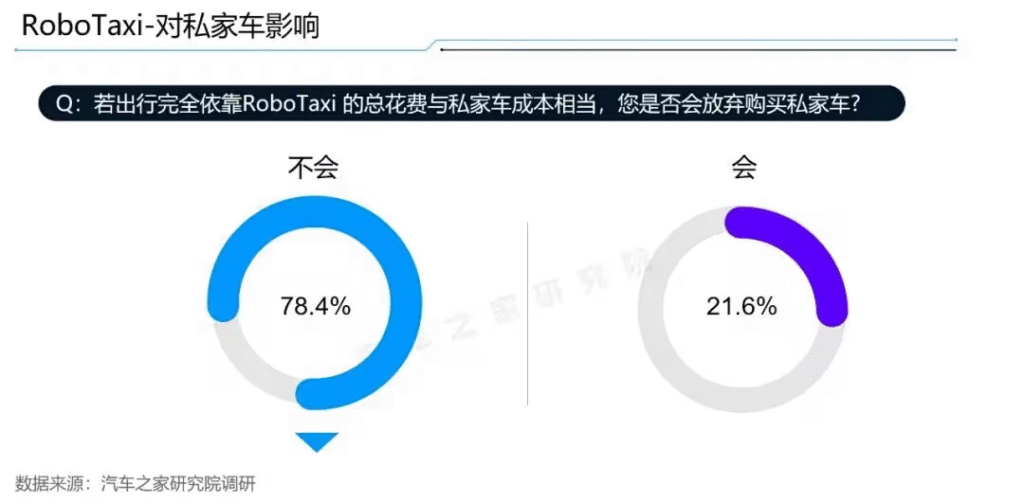

Changes in user travel behavior will inevitably have a certain impact on private car sales. Therefore, we specifically asked users: If the cost of RoboTaxi and private cars were comparable, would they give up their own cars? Nearly 80% of users said they would not give up their private cars, primarily because they believe private cars offer greater flexibility and personal space . Of course, this data is based on the assumption that autonomous driving technology is still immature and consumers remain conservative. In the long term, we remain concerned about the potential impact of this business model on private car sales. Even as a defensive strategy, OEMs should consider preemptively developing a “dual-track” product plan for RoboTaxi and private cars, building organizational capabilities for integrated operations.

Autohome AH-IT Smart Review

Assisted driving still lacks a sense of safety, and voice intelligent assistance is still in its early stages of development

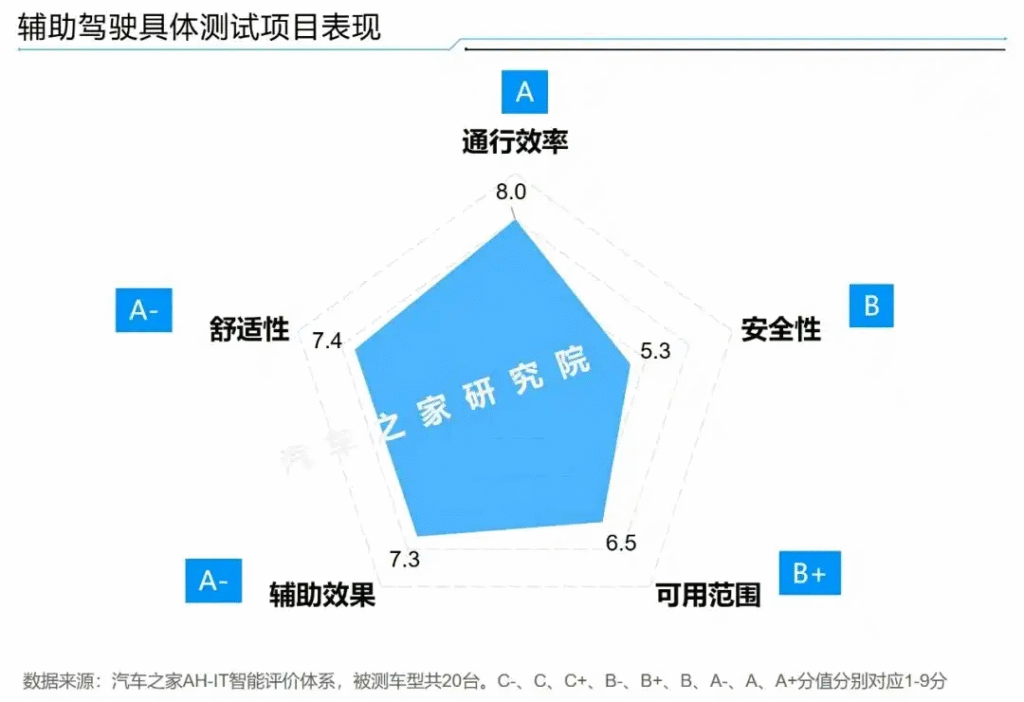

To provide users with a truly intelligent experience, the 2025 Autohome AH-IT intelligent evaluation system has been revamped. 20 flagship new cars from popular brands were selected for evaluation based on six intelligent scenarios and three specialized areas. The evaluation comprehensively reflects the level of intelligence in three key areas: assisted driving, smart parking, and intelligent voice control.

First is assisted driving. Through evaluation, we found that the average rating level for assisted driving can reach between A- and A. Among them, the lack of safety is the biggest shortcoming of assisted driving at present , which has only reached the level of B. 85% of the tested models have caused dangerous interventions or dangerous behaviors. Even if there is zero takeover throughout the entire process, it does not mean that dangerous behaviors will not occur during longer driving distances. Among the six affordable models tested this time, 67% of the models have assisted driving ratings of A- or above. The lowest-priced Xiaopeng MONA M03 assisted driving rating has also reached the A level, which is comparable to luxury cars. The price of the car has been completely untied from the level of assisted driving , and the era of “universal intelligent driving” has arrived.

Now let’s look at smart parking. Currently, parking assistance has reached a very high level . Even with some “poor students” lagging behind, the average rating is almost an A-. Regular, perpendicular, and side parking spaces all passed with 100% success. Diagonal parking spaces were also very efficient, with an average time of just 25 seconds. Seven models failed, two of which did not support or could not identify the parking spaces. The other five models could park in the rear, but because the test requirements were higher and required the front of the vehicle, they were deemed failures. While difficult parking spaces were not 100% successful, the success rate for multiple interference spaces and narrow dead-end spaces reached 90%, which is truly remarkable.

In terms of smart cockpit voice interaction, Autohome set up 20 test questions, covering difficulty levels from low to high, including basic command execution, information query, vehicle thinking and reasoning, intelligent assistance, and active management. In the end, a total of 8 models received A-level evaluation in the voice performance link. Models with a rating of B have minor flaws in the execution of basic commands, such as the inability to fully execute complex audio and video entertainment commands, or the inability to set preferences for navigation routes. However, the top students still have a lot of room for improvement in intelligent assistance and active management . Only three models support takeout ordering and scene creation capabilities. Of course, voice interaction is still a shortcoming for overseas brand models, and the average rating level is far lower than that of Chinese brands .

Conclusion

China’s electric vehicle intelligent development has entered a new phase. Five major trends in intelligent development will reshape competition in the intelligent driving market. This restructuring will first manifest itself in the far-reaching impact of “smart driving equality .” The potential for monetization through Level 2 assisted driving will be reduced, while Level 3 may become the next commercial breakthrough. The demand for test drive services will also rise, and user education on the technical side must also be strengthened. Second, this will lead to a shift in the focus of intelligent vehicle competition . Core technologies such as intelligent air suspension, high-voltage fast charging within 15 minutes, and multimodal in-cabin interaction, along with soft-cockpit experiences, may replace high-speed and urban NoA as new drivers of high-end differentiation. In particular, the deep integration of large AI models has become a new competitive focus. Third, RoboTaxi may trigger strategic adjustments among automakers . Considering its potential impact on the private car market in the medium and long term, a dual-track product strategy combining RoboTaxi and private cars may be a forward-looking option.

Autohome Research Institute will be user-oriented, continue to focus on the intelligent development of the Chinese automobile market, and provide support for manufacturers’ marketing decisions.